When it comes to financing significant purchases or managing unexpected expenses, loans can be a crucial resource. Car loans and personal loans are two of the most common types of loans individuals consider. While both serve the purpose of providing necessary funds, they differ significantly in terms of structure, purpose, and benefits. In this article, we delve into the intricacies of difference between car loan and personal loan, offering a comprehensive comparison to help you make informed financial decisions.

What is Car Loans

Car loans are specifically designed to facilitate the purchase of a vehicle. They are secured loans, meaning the vehicle itself serves as collateral. This collateralization often leads to more favorable interest rates compared to unsecured loans.

Features of Car Loans

- Purpose-Specific: Car loans are intended exclusively for the purchase of a vehicle, be it new or used.

- Collateral: The car purchased with the loan acts as collateral, providing security to the lender.

- Interest Rates: Typically, car loans offer lower interest rates due to the secured nature of the loan.

- Loan Tenure: Car loans generally have a fixed repayment period, ranging from 3 to 7 years.

- Down Payment: A down payment is usually required, which reduces the loan amount and the lender’s risk.

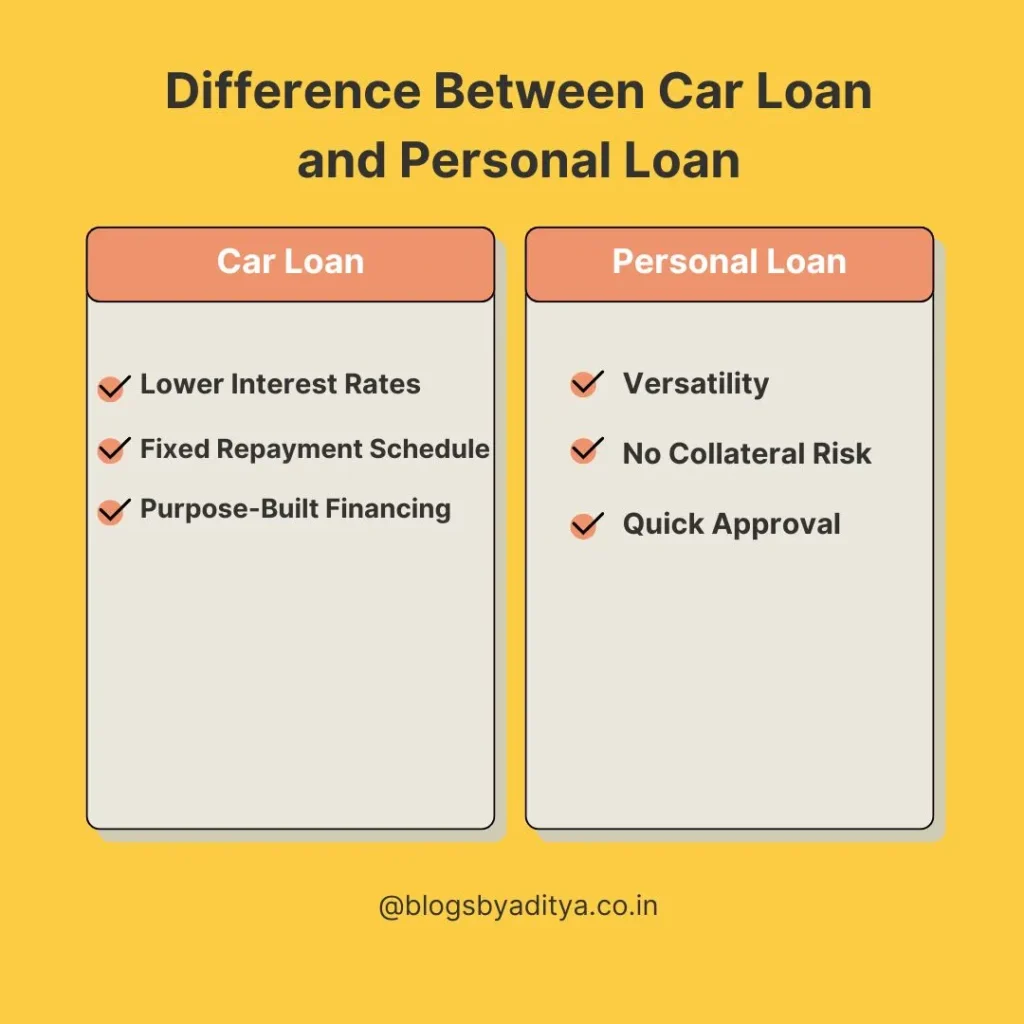

Advantages of Car Loans

- Lower Interest Rates: Secured by the vehicle, car loans often have lower interest rates.

- Fixed Repayment Schedule: Predictable monthly payments make budgeting easier.

- Purpose-Built Financing: Designed specifically for vehicle purchases, making the process straightforward.

Disadvantages of Car Loans

- Restricted Use: Funds can only be used for purchasing a vehicle.

- Depreciation: Vehicles depreciate over time, which can lead to owing more than the car’s value.

- Repossession Risk: Defaulting on payments can result in the lender repossessing the vehicle.

What is Personal Loans

Personal loans are versatile, unsecured loans that can be used for a wide range of financial needs, from consolidating debt to financing a major purchase or covering unexpected expenses.

Features of Personal Loans

- Flexibility: Can be used for virtually any purpose, offering significant flexibility.

- No Collateral Required: These loans do not require any collateral, making them accessible to individuals without significant assets.

- Interest Rates: Interest rates on personal loans are generally higher than those on secured loans.

- Loan Tenure: Personal loans typically have repayment periods ranging from 1 to 5 years.

- Credit-Based: Approval and interest rates are heavily influenced by the borrower’s creditworthiness.

Advantages of Personal Loans

- Versatility: Funds can be used for any personal financial need.

- No Collateral Risk: There’s no risk of losing a personal asset due to default.

- Quick Approval: Personal loans often have a faster approval process.

Disadvantages of Personal Loans

- Higher Interest Rates: Due to the lack of collateral, personal loans often come with higher interest rates.

- Credit Score Dependent: Borrowers with lower credit scores may face higher rates or difficulty getting approved.

- Variable Terms: Depending on the lender, terms can vary widely.

Key Difference Between Car Loan and Personal Loan

Purpose and Use

- Car Loan: Specifically for purchasing a vehicle.

- Personal Loan: Can be used for a wide variety of personal financial needs.

Collateral

- Car Loan: Requires the purchased vehicle as collateral.

- Personal Loan: Typically unsecured, requiring no collateral.

Interest Rates

- Car Loan: Generally lower due to the secured nature.

- Personal Loan: Typically higher as they are unsecured.

Repayment Terms

- Car Loan: Fixed terms, usually between 3 to 7 years.

- Personal Loan: Variable terms, typically between 1 to 5 years.

Approval Process

- Car Loan: Approval may be simpler with lower rates due to the collateral.

- Personal Loan: Approval depends more heavily on creditworthiness and financial history.

Consider Your Financial Situation

- Credit Score: Assess your credit score to understand which loan offers you might qualify for.

- Repayment Ability: Evaluate your ability to make consistent monthly payments.

- Loan Amount: Determine the amount you need and whether it aligns with the type of loan you’re considering.

Evaluate Loan Offers

- Interest Rates: Compare rates from various lenders to find the most competitive offers.

- Loan Terms: Look at the repayment terms to ensure they fit within your financial plans.

- Additional Fees: Be aware of any additional fees or charges associated with the loan.

Comparison of Car Loans and Personal Loans

Loan Approval Process

Understanding the approval process for both car loans and personal loans can help you better prepare and improve your chances of securing the best possible terms.

Car Loan Approval Process

The approval process for a car loan involves several steps:

- Application: You’ll need to provide personal information, including proof of income, employment history, and credit history.

- Down Payment: A down payment is typically required. The size of the down payment can affect the loan terms and interest rate.

- Credit Check: Lenders will perform a credit check to assess your creditworthiness. A higher credit score can help you secure lower interest rates.

- Vehicle Appraisal: For used cars, lenders may require an appraisal to determine the vehicle’s value.

- Loan Offer: Based on your application, credit check, and the vehicle’s value, the lender will present a loan offer detailing the amount, interest rate, and repayment terms.

- Approval and Disbursement: Once you accept the loan offer, the lender will disburse the funds, usually directly to the car dealer.

Personal Loan Approval Process

The approval process for a personal loan is generally straightforward:

- Application: You’ll need to provide personal and financial information, including proof of income, employment status, and credit history.

- Credit Check: Lenders will conduct a credit check to evaluate your credit score and history. Good credit can lead to better loan terms.

- Loan Offer: Based on your application and credit check, the lender will present a loan offer, which includes the loan amount, interest rate, and repayment terms.

- Approval and Disbursement: Once you accept the loan offer, the funds are typically disbursed directly to your bank account, often within a few days.

Cost Considerations

Both car loans and personal loans come with costs beyond just the principal and interest payments. Being aware of these costs can help you make a more informed decision.

Car Loan Costs

- Interest Rates: Generally lower due to the secured nature of the loan.

- Down Payment: An upfront cost that reduces the overall loan amount and interest paid over the life of the loan.

- Insurance: Comprehensive car insurance is often required by lenders to protect their collateral.

- Fees: Potential fees include loan origination fees, processing fees, and prepayment penalties.

Personal Loan Costs

- Interest Rates: Typically higher since the loan is unsecured.

- Fees: Common fees include loan origination fees, late payment fees, and sometimes prepayment penalties.

- Variable Costs: If you choose a loan with variable interest rates, your monthly payments can fluctuate, impacting your budget.

Impact on Credit Score

Both types of loans can affect your credit score, but in different ways.

Car Loans and Credit Scores

- Positive Impact: Timely payments on a car loan can positively impact your credit score by demonstrating responsible credit behavior.

- Negative Impact: Missing payments or defaulting on the loan can significantly harm your credit score. Additionally, taking on a large loan relative to your income can increase your debt-to-income ratio, which can negatively affect your credit.

Personal Loans and Credit Scores

- Positive Impact: Like car loans, making timely payments on a personal loan can help improve your credit score. It can also diversify your credit mix, which is beneficial.

- Negative Impact: Late payments or defaulting can damage your credit score. Additionally, a high utilization rate on an unsecured loan can negatively impact your credit rating.

Choosing the Right Lender

Whether opting for a car loan or a personal loan, selecting the right lender is crucial. Consider the following factors:

- Reputation: Research lenders’ reputations through reviews and ratings. Look for lenders known for transparent practices and excellent customer service.

- Interest Rates: Compare interest rates from multiple lenders to find the most competitive rates.

- Loan Terms: Ensure the repayment terms align with your financial capabilities and goals.

- Additional Services: Some lenders offer additional services, such as financial counseling or flexible repayment options, which can be beneficial.

Which Loan is Right for You?

The choice between a car loan and a personal loan hinges on your specific needs and financial situation. If you’re looking to purchase a vehicle and can afford a down payment, a car loan might be the best option due to lower interest rates and fixed repayment schedules. On the other hand, if you need funds for a broader range of uses, a personal loan offers greater flexibility, albeit at potentially higher interest rates.

Making the right choice between a car loan and a personal loan involves careful consideration of your financial needs, creditworthiness, and long-term financial goals. While car loans offer lower interest rates and are tailored for vehicle purchases, personal loans provide flexibility and can be used for a variety of purposes. Evaluating the costs, approval processes, and potential impact on your credit score will help you make an informed decision that supports your financial well-being.